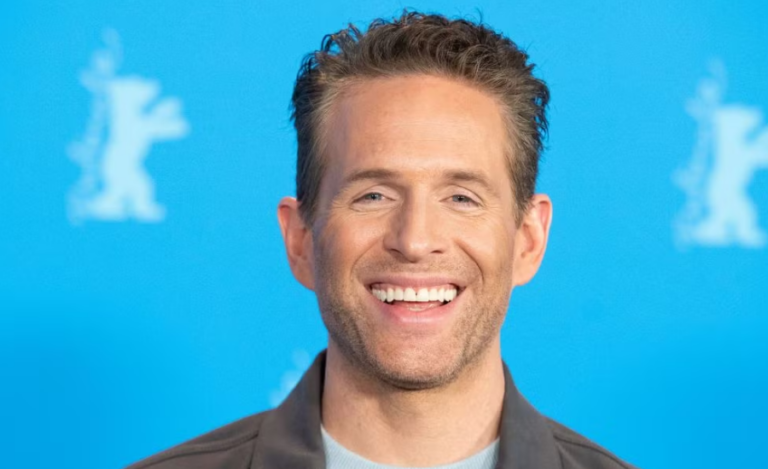

Chris Sacca, a name that resonates in the world of venture capitalism, has carved a legacy that few others in the industry can match. Chris Sacca net worth estimated at $1.3 billion as of 2024, Sacca’s success story is a testament to the power of strategic investment, foresight, and the ability to spot disruptive technologies long before they become household names. His journey from a young lawyer to one of Silicon Valley’s most influential investors highlights the potential of calculated risks and the value of investing in startups at their earliest stages.

Early Life and Career Beginnings

Chris Sacca was born in Lockport, New York, in 1975. Raised in a middle-class family, Sacca’s early interest in technology and business was fostered by a combination of academic achievements and a natural aptitude for understanding how systems worked. He attended the University of Rochester, where he earned a degree in economics, and later, he went on to earn a J.D. from the Pepperdine University School of Law.

After completing his legal education, Sacca initially worked as a lawyer at a prestigious firm, but he soon realized that his true passion lay not in law but in technology and investment. Armed with his legal expertise and a sharp business mind, he transitioned into the tech world, where he would ultimately make his mark.

The Road to Venture Capital

Chris Sacca’s first major break came in the early 2000s when he joined the tech giant Google. At Google, Sacca worked on the company’s business development team, gaining firsthand experience in the inner workings of one of the world’s most successful companies. His time at Google exposed him to the power of tech startups and the importance of investing in early-stage companies with disruptive potential.

After his stint at Google, Sacca moved on to venture capital. He realized that his skills in spotting potential success stories were valuable assets in the investment world. In 2007, he founded his venture capital firm, Lowercase Capital. This was the beginning of a journey that would lead to some of the most lucrative investments in the tech industry.

Investments That Shaped Sacca’s Fortune

Chris Sacca’s portfolio is a collection of some of the most influential companies of the past two decades. His strategy was clear: identify companies with a unique product or service, a strong founding team, and the potential to scale quickly. These were the companies that Sacca would take an interest in, often investing in them during their earliest rounds of funding.

1. Twitter

Perhaps Sacca’s most famous and lucrative investment was in Twitter. In 2008, Twitter was just a fledgling social media platform with a small user base. However, Sacca saw the potential in the platform’s real-time communication model and invested early. Twitter eventually became one of the largest social media platforms globally, and Sacca’s early investment paid off massively.

Sacca’s relationship with Twitter didn’t end with his investment. He played an instrumental role in helping the company navigate its early growth challenges. His ability to understand the market and offer valuable advice helped shape Twitter into the powerhouse it became.

2. Uber

Another cornerstone of Sacca’s fortune was his early investment in Uber. At the time, Uber was still a small ride-hailing service operating in a handful of cities. However, Sacca saw the transformative potential of Uber’s model and recognized that it had the ability to revolutionize the transportation industry.

As Uber grew into a global brand, Sacca’s early investment continued to appreciate, making it one of the most significant contributors to his net worth. His strategic input and belief in Uber’s founders, Travis Kalanick and Garrett Camp, helped shape the company’s trajectory during its formative years.

3. Instagram

Before Facebook acquired Instagram for $1 billion in 2012, the photo-sharing app was still in its infancy. Sacca, however, recognized the potential of the platform and made an early investment. Instagram’s rapid growth, combined with Facebook’s acquisition, ensured that Sacca’s stake in the company would contribute significantly to his wealth.

4. Other Key Investments

In addition to Twitter, Uber, and Instagram, Sacca’s venture capital firm made a number of other successful investments. These include companies like Kickstarter, the crowdfunding platform; The Seattle-based tech company, Birchbox; and the popular blogging platform, WordPress.

Each of these investments, though varied in industry, shared a common trait: they were all companies that had the potential to disrupt traditional industries and create new markets. Sacca’s ability to spot these opportunities and invest in them early was the key to his success.

The Rise of Lowercase Capital

Lowercase Capital, Sacca’s venture capital firm, was instrumental in executing his vision of supporting high-growth tech companies. As the firm grew, so did Sacca’s reputation. He became known for his hands-on approach with startups, offering more than just capital—he provided mentorship, strategic advice, and introduced companies to key industry contacts.

Lowercase Capital’s success was built on a foundation of trust and mutual respect with entrepreneurs. Sacca’s track record of backing winners helped him establish strong relationships with founders, which further fueled his success in the venture capital space.

Sacca’s Personal Life and Public Persona

Despite his immense success in the tech world, Sacca has remained relatively low-key about his personal life. He is known for his humility and grounded approach to life, despite his wealth and fame. In interviews, Sacca often emphasizes the importance of family and community, and he remains active in supporting various philanthropic causes.

Sacca’s public persona has also been shaped by his appearances on the popular TV show Shark Tank. As one of the guest investors on the show, Sacca used his platform to promote his investment philosophy and provide advice to budding entrepreneurs.

Sacca’s Wealth Today

As of 2024, Chris Sacca net worth is estimated to be around $1.3 billion. This wealth comes from his early-stage investments in companies like Twitter, Uber, and Instagram, as well as other ventures through Lowercase Capital. His portfolio continues to generate significant returns, and Sacca remains a key figure in the venture capital world.

While Sacca has made billions through his investments, he has also been known for his philanthropic efforts. He has pledged to donate a significant portion of his wealth to causes such as environmental sustainability and education, further cementing his legacy as not just a successful investor but also a socially responsible individual.

Conclusion

Chris Sacca’s journey from a law school graduate to a billionaire venture capitalist is a remarkable story of vision, timing, and expertise.Chris Sacca net worth, estimated at $1.3 billion, reflects his ability to identify high-potential startups and invest in them at critical junctures. Sacca’s success in venture capital is a prime example of how calculated risks, deep industry knowledge, and a passion for innovation can lead to extraordinary financial success. As the tech world continues to evolve, Sacca’s investments will likely remain a cornerstone of his legacy.

FAQs about Chris Sacca net worth

1. How did Chris Sacca make his money?

Sacca earned his fortune by investing early in companies like Twitter, Uber, and Instagram through his venture capital firm, Lowercase Capital.

2. What is Chris Sacca net worth?

As of 2024,Chris Sacca net worth is estimated at $1.3 billion.

3. What companies has Chris Sacca invested in?

He has invested in Twitter, Uber, Instagram, Kickstarter, and WordPress, among others.

4. Is Chris Sacca still involved in venture capital?

He’s stepped back from active investing but remains a respected figure in the industry.

5. What is Chris Sacca’s investment strategy?

He focuses on early-stage investments in disruptive companies with strong founding teams.

6. What philanthropic causes does Chris Sacca support?

Sacca supports environmental sustainability and education, pledging significant donations to these causes.

Stay connected for fresh updates and timely alerts: Buzz Feed